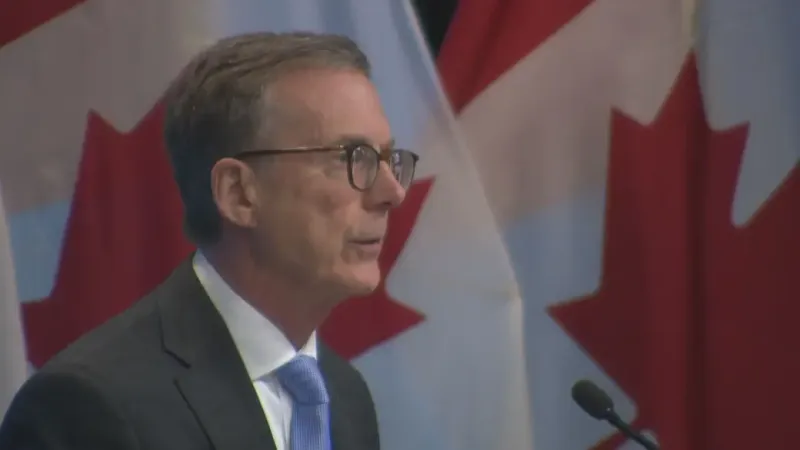

Bank of Canada worried jumbo rate cut would send sign of ‘economic trouble’

That oversized step brought the policy rate down to 3.75 per cent.

Newly released documents reveal that the Bank of Canada’s top decision-makers were concerned that the central bank’s substantial interest rate cut in October might signal a negative outlook on the Canadian economy.

On October 23, the Bank of Canada implemented a rare 50-basis-point reduction to its benchmark interest rate, marking the fourth consecutive cut and the largest one in 15 years, aside from the initial days of the COVID-19 pandemic. This move lowered the policy rate to 3.75 percent.

However, a summary of the governing council's discussions shows that some officials worried this significant cut could be interpreted as a sign of economic trouble. They feared it might lead to expectations of further substantial cuts or assumptions that the policy interest rate would need to remain very accommodative in the future.

“Since a 50-basis-point cut is unusual, some members expressed concern that it might be interpreted as a sign of economic trouble, leading to expectations of further moves of this size or to assumptions that the policy interest rate would need to become very accommodative in the future,” the deliberations read.

The Bank of Canada's policy rate typically influences borrowing costs across Canada. The central bank's primary mandate is to keep inflation at 2 percent, raising rates when inflation is too high and cutting them if the economy slows to the point where inflation risks falling too far below target.

Sharp reductions in the policy rate may suggest concerns that monetary policy has been too tight for the economy, signaling that the Bank of Canada might be behind the curve and that an economic contraction could be looming.

With inflation dropping to 1.6 percent in September—arriving at the target more quickly than the Bank had predicted—the governing council expressed growing confidence that inflation was under control. However, weakness in the labor market and a more pronounced slowdown expected in the second half of 2024 led central bank officials to conclude that the economy was in "excess supply." While the Bank projects a return to growth in the coming years, the deliberations noted uncertainty about the timing of that recovery, which risks pushing inflation too far below the 2 percent target.

While the council considered a more typical 25-basis-point cut in October, a "strong consensus" emerged for the larger 50-basis-point reduction.

Officials made it clear that Canadians and market observers should not expect similar half-point cuts at every meeting, stressing in their communications that future decisions would be made "one meeting at a time, guided by incoming data."

The Bank of Canada’s final rate decision for the year is scheduled for December 11, with another rate cut widely anticipated.