Canada's budget watchdog re-ran the numbers on the carbon tax — here's what it found

Parliamentary Budget Office re-did its analysis after what it called an 'inadvertent error'

After identifying what it called an "inadvertent error," Canada’s independent budget watchdog re-ran its analysis of the federal carbon tax and rebates, reaching similar conclusions regarding how many Canadians receive more in rebates than they pay in carbon tax.

However, when considering the impact on the economy and household income by 2030-31, the Parliamentary Budget Officer (PBO) reported that the costs to households will be lower than initially predicted, as the previous report had mistakenly factored in the industrial carbon pricing system.

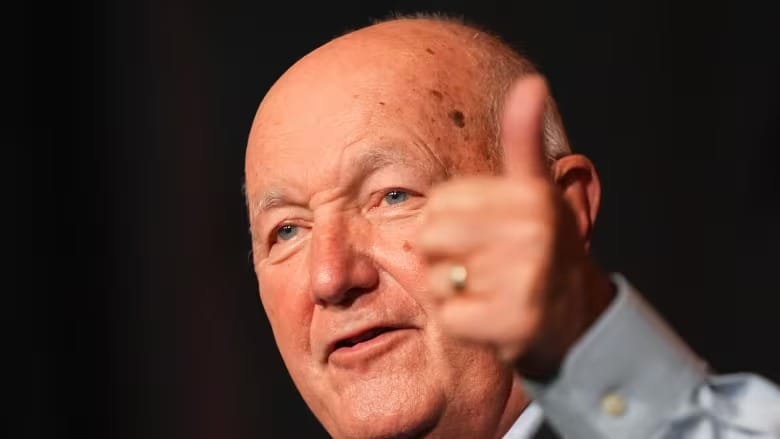

In Thursday’s updated report, PBO Yves Giroux found that considering household costs from the consumer fuel levy, GST, and indirect costs tied to the carbon tax, most households will experience a net gain by 2030-31. The report also noted that, overall, households will see larger net gains and lower costs compared to the previous analysis.

Despite these net gains, the PBO stated that households will still be worse off by 2030-31 when the broader economic impact, including effects on GDP and investment income, is taken into account — although not as severely as the earlier report from March had suggested. The PBO explained that "since the fuel charge lowers employment and investment income, which form a larger portion of income for higher-income households, their net cost is higher."

Canadians outside Quebec and British Columbia pay the federal carbon tax on consumer fuels, with most receiving rebates. The next rebate is scheduled for Tuesday.

Large emitters in industries like oil, gas, and steel pay carbon pricing through a separate industrial pricing system. Earlier this year, the PBO admitted its previous economic analysis mistakenly included this system in calculations.

As with previous reports, this updated analysis does not account for the benefits of emission reductions or the economic costs of climate change, nor does it explore the impacts of alternative policies.

The Parliamentary Budget Office, a non-partisan body providing economic analyses for MPs and senators, emphasized that while the updated report yields similar conclusions to its earlier analysis, the estimated household net costs are significantly lower. For instance, in Alberta, the PBO's revised estimate reduced the average household net cost from $2,773 to $697 for 2030-31.

The tone of the report also shifted, addressing key political debates. It emphasized that the report is not an endorsement of abandoning carbon pricing: “It should not be seen as an alternative policy option of ‘doing nothing’ if the economic impact of carbon pricing is negative.”

The federal carbon tax has become a major target for Conservatives, with leader Pierre Poilievre holding rallies to call for its elimination. He claims that the tax is impoverishing Canadians, and that a continued increase would cause "mass hunger" and an "economic nuclear winter."

Environment and Climate Change Minister Steven Guilbeault responded to the report, calling it an “important correction” that refutes Poilievre’s claims. "This clears the air on Pierre Poilievre's big lie and shows that carbon pricing is the most cost-effective way to fight climate change," said Guilbeault.

Poilievre's office reiterated that the PBO report supports the Conservative position that the carbon tax is detrimental to Canadians. However, the advocacy group Climate Action Network Canada argued that the political focus on carbon pricing is overlooking the bigger issue — the escalating costs of climate change itself. "With every heat wave and flood, Canadians are paying the real price of climate change," said the network's national policy manager, Alex Cool-Fergus.

When asked whether Poilievre’s predictions of economic disaster might materialize, PBO Giroux said, "The numbers that were provided to us don't suggest that it would be that catastrophic." Some data in Giroux’s report was sourced from Environment and Climate Change Canada.