Canada's digital services tax set for a reckoning with U.S.

75 day consultation period for dispute filed by U.S. expires this week

The ongoing dispute over Canada's digital services tax (DST) may intensify this week as the deadline approaches for the Biden administration to decide whether to proceed with dispute arbitration, amidst threats of retaliation from the incoming Trump administration.

On August 30, U.S. Trade Representative (USTR) Katherine Tai filed an official complaint under the Canada-United States-Mexico Agreement (CUSMA), alleging that Canada’s recently introduced 3% tax unfairly discriminates against American companies. This initiated a 75-day consultation period, which is set to conclude this week. However, with President Joe Biden’s administration nearing its end, it remains uncertain whether Tai will escalate the issue by requesting arbitration to determine if Canada’s tax violates CUSMA.

Another option for the USTR is to allow the complaint to be deferred, potentially leaving the matter for the incoming Trump administration to address, which could carry greater risks for Canada.

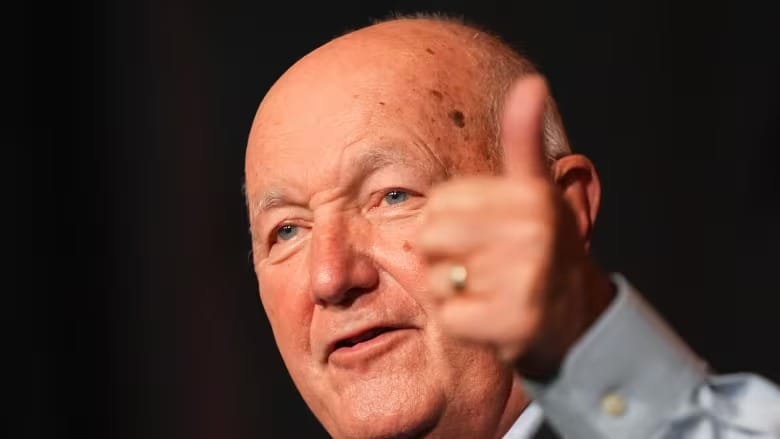

"The first Trump administration was very clear on digital services taxes," said John Dickerman, the Washington-based policy vice-president for the Business Council of Canada. "They saw such taxes as a clear sign of a country targeting U.S. companies. It will be a 'with us or against us' scenario, with little room for negotiation on DST."

When the USTR initiated the dispute with Canada, it also reaffirmed its support for U.S. Treasury Secretary Janet Yellen's participation in multilateral talks among OECD and G20 countries to find a global solution for taxing large tech firms. These countries are working together to prevent digital companies from exploiting competitive jurisdictions to avoid taxes.

However, Dickerman warned that under a Trump administration, multilateral efforts might be sidelined in favor of bilateral negotiations. "Multilateral solutions aren't as appealing as bilateral solutions," he said.

The DST applies to companies generating over $20 million in annual revenue from Canadian sales of online advertising, social media, streaming services, or data storage. It targets large tech giants once their global revenue exceeds 750 million euros ($1.1 billion Cdn), and excludes smaller startups.

One of the key concerns from groups like the Canadian Chamber of Commerce has been the risk of direct tariff retaliation from the U.S., which has opposed the DST from the start. Ontario Premier Doug Ford called for the tax to be paused even before the recent election, citing the strong backlash from Americans.

Had Democrats secured more seats in Congress, there might have been more patience for engaging in the multilateral process championed by Yellen and Finance Minister Chrystia Freeland. Populist calls to break up large tech companies or ensure they pay their fair share of taxes had gained traction before the election, but the Biden administration’s response to the issue has been limited, frustrating more hawkish voices in Congress.

The incoming Trump administration is expected to be more aligned with tech moguls like Elon Musk, which could affect Canada’s DST. "A number of the key digital executives did reach out to Trump during the election," noted trade lawyer Mark Warner. He expressed concern that this might signal trouble for Canada’s tax once Trump takes office.

"Digital issues are easily framed as 'Canada is going after our big companies,'" Warner said. "It's easy to make this a political issue — 'You're our ally, yet you're targeting our corporations. What’s going on?'"

Despite earlier U.S. threats, Freeland’s office has pointed out that several European countries, including France, the UK, and Italy, have implemented similar taxes.

"Some of the world’s largest firms are not paying their fair share in Canada, despite making huge profits here," said Freeland’s spokesperson, Katherine Cuplinskas. "That puts Canada at a significant disadvantage."

While Canada prefers a multilateral solution, Freeland’s office emphasized the significant concessions Canada has already made to support international negotiations, including delaying the DST’s implementation. "We look forward to working with President Trump and his administration on important cross-border issues," Cuplinskas added.

Canada’s government had hoped the DST would generate over $7 billion in the first five years, but it may now need to reconsider this goal to avoid punitive measures under Trump’s leadership. This could be disappointing to progressives like the New Democrats, who have long argued that large corporations should pay their fair share of taxes, but Ottawa may need to focus on avoiding greater economic harm.

Trump’s former national security adviser, Robert C. O'Brien, recently warned that "allies who seek to constrain the U.S. economically must be reminded that our global technology leadership, including in the digital services market, is a national security issue for the U.S."

Even if the Biden administration decides to escalate the dispute, it’s uncertain whether Canada will be able to defend its tax. Elizabeth Trujillo, a law expert at the University of Houston, pointed out that Canada might claim a "safe harbour" under CUSMA’s cultural exception, which protects the country’s right to support its arts and media industries. However, she noted that it’s debatable whether this exception could apply to the DST.

With the World Trade Organization also grappling with the challenges of the digital economy, Trujillo warned that this issue could resurface during CUSMA’s mandatory review in 2026, or even lead to a full renegotiation.

"These issues are already creating tension," she said.