China hits Canada with anti-dumping canola probe after EV tariffs

“China strongly deplores and firmly opposes the discriminatory unilateral restrictive measures taken by Canada against its imports from China despite the opposition and dissuasion of many parties,” a commerce ministry spokesperson said in a statement.

China announced on Tuesday that it will launch an anti-dumping investigation into canola imports from Canada, following Ottawa's recent decision to impose tariffs on Chinese electric vehicles. This move pushed domestic rapeseed oil futures in China to a one-month high.

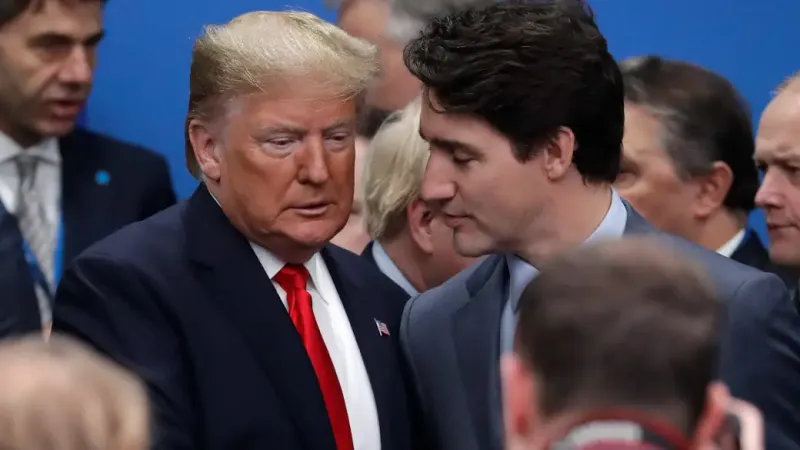

Canada, aligning itself with the United States and the European Union, recently imposed a 100 percent tariff on Chinese electric vehicles and a 25 percent tariff on Chinese steel and aluminum imports.

In response, a spokesperson for China’s commerce ministry expressed strong disapproval, stating, "China strongly deplores and firmly opposes the discriminatory unilateral restrictive measures taken by Canada against its imports from China despite the opposition and dissuasion of many parties." The ministry also announced plans to investigate anti-dumping practices concerning some Canadian chemical products.

China is the largest importer of oilseeds globally, and over half of Canada’s canola production is exported to China. Canola, also known as rapeseed in certain varieties, is widely used in cooking oils and various products, including renewable fuels.

Following the announcement, China’s rapeseed meal futures on the Zhengzhou Commodity Exchange surged six percent to 2,375 yuan ($333.56) per metric ton, reaching their highest level since August 6. Conversely, the ICE canola contract for November delivery dropped by $45, or seven percent, to $569.7 per metric ton.

The commerce ministry stated, "Canada’s canola exports to China have increased significantly and are suspected of dumping, reaching US$3.47 billion in 2023, with a 170 percent year-on-year increase in volume and a continuous decline in prices." The ministry further noted that this "unfair competition" has led to ongoing losses for China’s domestic rapeseed industries. So far this year, China’s rapeseed meal prices have fallen by 22 percent due to an abundant oilseed supply and rising domestic production.

Ma Wenfeng, a senior analyst at Beijing Orient Agribusiness Consultancy, commented, "The current (edible oil) domestic consumption is not strong, and there is an abundant supply of domestic stocks." China primarily imports canola from Canada, followed by Russia and Mongolia. Ma added, "Arrivals from Canada have been growing at a fast rate." In 2023, China imported 5.5 million tons of canola, valued at $3.72 billion, with 94 percent of the total coming from Canada.

In contrast, the bulk of China’s electric vehicle exports to Canada come from Tesla’s Shanghai factory, with limited involvement from local Chinese firms. Canadian imports of automobiles from China surged by 460 percent year-over-year to 44,356 in 2023, driven by Tesla's shipments of Shanghai-made EVs to Canada.

The Chinese spokesperson indicated that China plans to address Canada’s actions through the World Trade Organization's dispute settlement mechanism. The Canadian embassy in Beijing has not yet responded to requests for comment.

China has also launched trade investigations into imports of pork, brandy, and dairy from the European Union in response to restrictions on its electric vehicle exports.

China had previously targeted Canadian canola during past trade tensions, suspending two Canadian canola exporters in 2019 before lifting the restrictions three years later. Analysts suggest that China might turn to Australia and Ukraine for alternative canola supplies, especially given Australia’s ample production. While canola production in Europe has been affected by poor weather, China’s agricultural trade with Ukraine remains limited.

Ole Houe, director of advisory services at IKON Commodities in Sydney, noted, "We expect China to buy larger volumes from Australia if restrictions on Australian canola are eased." He added, "As of now, Australia’s canola exports to China are negligible, just about 500 tons since the beginning of 2024." China’s imports of Australian canola have been limited due to concerns about blackleg disease.

($1 = 7.1201 Chinese yuan renminbi)