Former U.S. ambassador questions Canada-U.S. trade relations after election

“I don’t know what a free trade agreement looks like when you have blanket tariff across the board.”

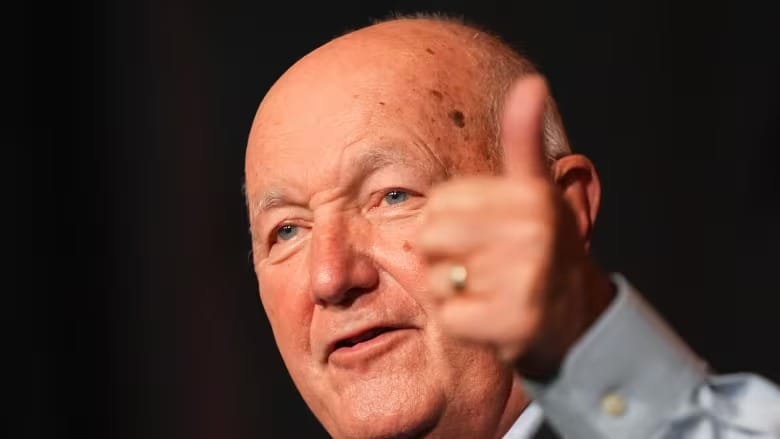

Bruce Heyman, former U.S. ambassador to Canada and a Democrat, recently commented on the potential impact of Donald Trump’s return to the White House on U.S.-Canada trade relations. He expressed concerns about Trump’s proposed tariff policies, which could significantly impact the current U.S.-Mexico-Canada Agreement (USMCA).

"If he imposes tariffs, as he has indicated, on all imported goods, then I’m not sure if the new USMCA, or however we want to define it, will actually still be effective,” Heyman stated. He added, “I don’t know what a free trade agreement looks like when there is a blanket tariff across the board.”

A report from TD Economics provided additional insights, examining how Trump's proposed 10% tariffs could impact Canada. The report estimates that such tariffs could reduce Canada’s export volumes to the U.S. by nearly 5% by early 2027 compared to baseline forecasts. Retaliatory measures from Canada might also increase production costs domestically, reducing import volumes further.

Wendy Wagner, co-leader of a national group on cybersecurity and data protection, highlighted another key concern: the upcoming joint review of the USMCA scheduled for 2026, which will decide whether the agreement will be extended another 16 years. She pointed out that if consensus isn’t reached in 2026, annual reviews will continue until 2036, prolonging uncertainty for Canada.

Heyman also noted that during these trade negotiations, Canada could face pressure due to issues between the U.S. and Mexico. He remarked, “The administration may use this trade agreement as a tool to apply pressure on Mexico, which could unfortunately extend to Canada."

TD Economics also warned that potential tariffs might lead to a “temporary and modest” inflation increase in Canada to around 2.5%-3%, impacting Canadian incomes negatively. This inflationary uptick is expected to revert to the Bank of Canada’s 2% target by 2026. The report further indicated that if tariffs do disrupt growth, the Bank of Canada might need to cut its policy rate by 50-75 basis points more than currently anticipated.