Inflation may have cooled, but private-label brands ‘having their moment’

Amid renewed investment by grocers in their store-branded offerings, studies show many shoppers no longer see store brands as lower quality than name brands.

In recent years, more consumers have been turning to private-label products at grocery stores to save money, and this shift seems to be lasting.

With increased investment from grocers in their store-branded products, studies show many shoppers no longer view private-label items as inferior to name brands.

"For customers, the private brand is becoming more than just a knockoff," said Annie St-Laurent, senior director for Metro's private-label division. "The growth in private labels is really strong."

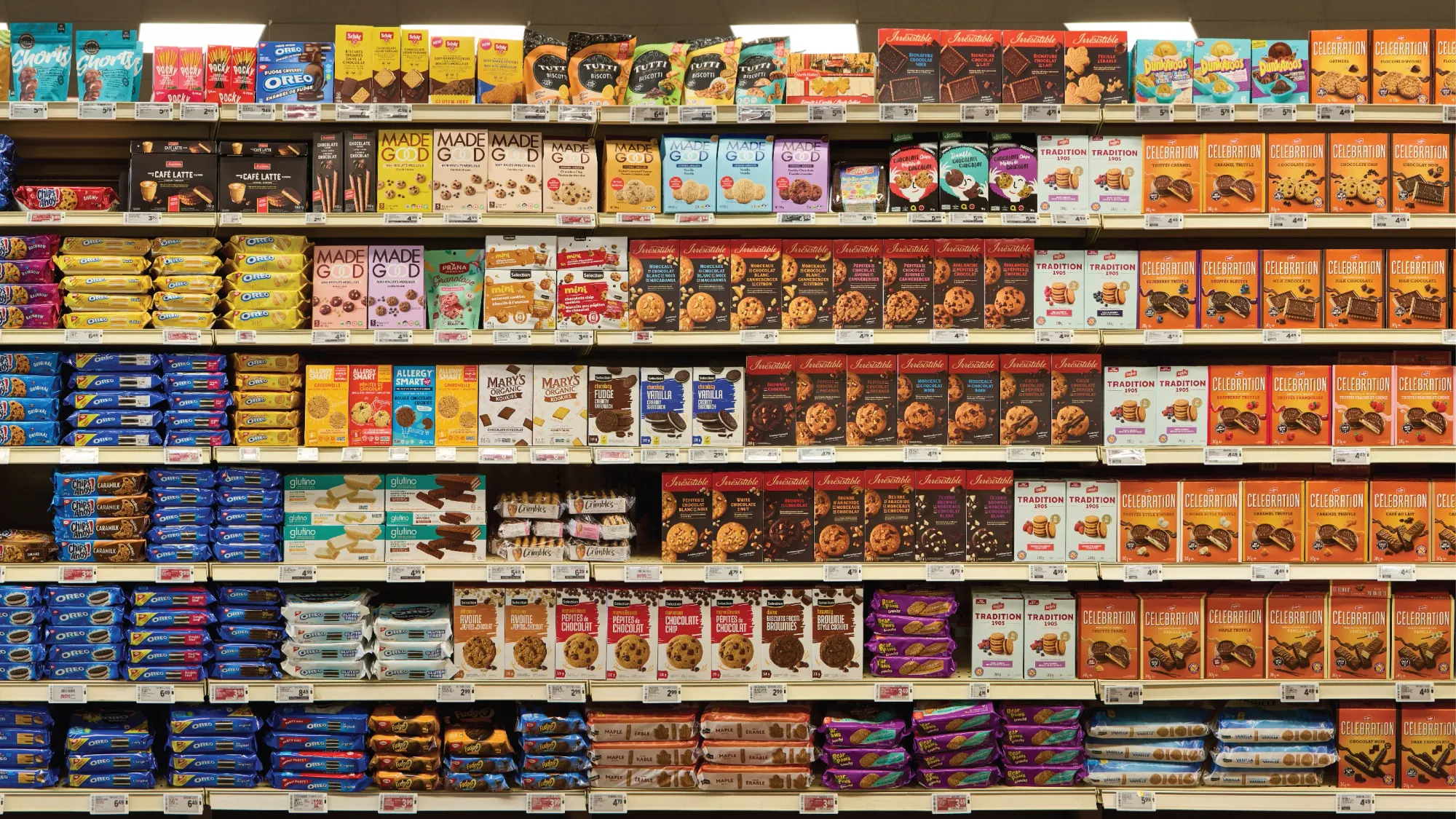

Grocery chains' in-house brands—such as Metro's Irresistible and Selection, Loblaw's No Name and President's Choice, and Sobeys' Compliments and Panache—are typically priced lower than national brands.

Private-label products are "having their moment," according to a report by agriculture-focused co-operative bank CoBank. As inflation has driven up prices and interest-rate hikes have added to financial pressure, shoppers are opting for store brands more often.

Retailers are responding to this trend by introducing new products and dedicating more shelf space to their store brands, said Peter Chapman, founder of consulting firm SKUFood. "We're seeing more depth within categories for private labels as retailers recognize the opportunity," he added.

According to market research firm NielsenIQ, retailers are also investing in new products as well as branding and marketing. Metro, for example, is set to launch a refresh of its core private-label brand, Irresistible, with a new logo, products, packaging, and flavors. St-Laurent noted that Metro aims to increase the brand's visibility throughout the store.

Metro has already been expanding its product range to meet growing demand for private-label items, offering new formats and price points. St-Laurent said sales growth in private-label products has been outpacing national brands, with shoppers increasingly open to trying them—a trend Metro expects to continue. "This is a priority for us," she added.

Christy Laverty, a shopper from Burlington, Ont., has been buying more store brands over the past couple of years due to rising prices. While certain name-brand products like Heinz ketchup and Kraft Dinner remain must-haves for her family, she has switched to private labels for many items, such as canned vegetables, beans, and dairy products.

"Why spend another 50 cents on a can of kidney beans when you don't need to?" Laverty said. She’s now always open to trying the store-brand version of a product and deciding if it's worth the switch.

Laverty also noted that her previous belief that private-label food was lower in quality has shifted. "I started to realize that store-brand, private-label items aren't necessarily of lesser quality," she said.

Consumer perceptions of private-label foods have improved significantly since the last time interest in store brands surged, during the 2008 recession, according to CoBank. This suggests that the rise of private-label products in grocery baskets may have greater staying power this time around.

Empire Co. Ltd., the parent company of Sobeys, FreshCo, and Safeway, stated in its 2024 annual report that it plans to continue growing and enhancing its store-brand portfolio. Loblaw's 2023 annual report also highlighted that customers' increased focus on value "benefited the company's sales due to its strength in private-label products, discount banners, and personalized promotions." The company even launched a new discount grocery banner this year under its No Name brand.

Private-label products often offer grocers better profit margins, and retailers see them as a form of "loyalty program" that encourages customers to return, said Chapman. He expects retailers to focus on maintaining private-label sales through new products, marketing, promotions, and prominent shelf space. "There's more effort now to ensure they deliver, as customers are giving them more chances," he said.

The growing competition from private-label products may prompt some national brands to offer more frequent discounts or promotions, according to Chapman.

For Kael Campbell, a shopper from Victoria, choosing private-label foods has made a noticeable difference in his grocery bill. Whether shopping at Costco, Walmart, or Thrifty Foods, Campbell often finds store-brand prices significantly lower for comparable items. "It really adds up," he said.