Is Pakistan’s $7bn IMF bailout package in trouble?

Pakistan’s deputy prime minister has accused the IMF of stalling on a loan deal, prompting concerns over its fate.

In July, Pakistan secured a staff-level agreement (SLA) with the International Monetary Fund (IMF) for a $7 billion, three-year loan program, which was seen as crucial for the government, newly in office, and for a country grappling with a severe economic crisis.

However, two months later, Pakistan is still awaiting formal approval from the U.S.-based lender, marking its 25th IMF program since the first bailout in 1958.

The IMF’s executive board, responsible for ratifying SLAs and releasing funds, has not yet scheduled Pakistan’s case for discussion. This delay has led to speculation that Pakistan may have failed to meet the IMF's conditions.

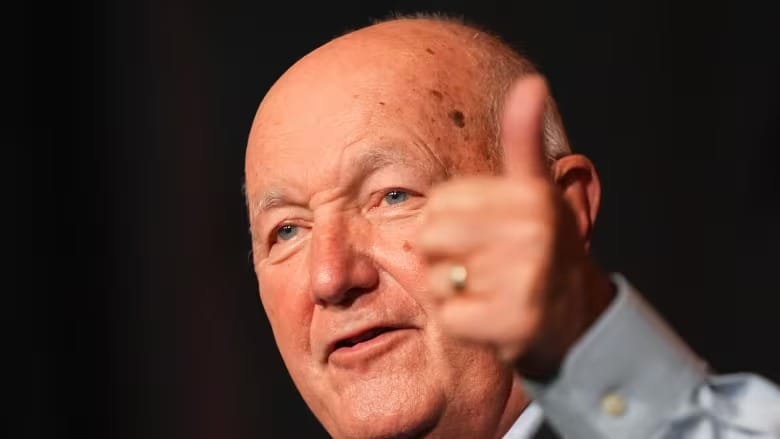

Earlier this week, Pakistan’s Deputy Prime Minister Ishaq Dar accused the IMF of “deliberately delaying” the funds.

“In the past two and a half years, efforts have been made to sabotage Pakistan’s critical negotiations with the IMF. There was geopolitics at play when Pakistan was close to default,” Dar said at an event in London on September 8.

“Why shouldn’t I raise a finger when our technical review is complete? Why are they wasting our time?” he added.

Economic Struggles in Pakistan

Pakistan’s economic crisis was aggravated by political instability, with both factors hitting the 241-million-strong nation almost simultaneously.

In 2019, then-Prime Minister Imran Khan secured a three-year IMF loan, but breached its terms by drastically cutting fuel prices in early 2022, just before his government was ousted in a parliamentary vote.

The succeeding coalition government, led by current Prime Minister Shehbaz Sharif, resumed the IMF program in August 2022, with Dar appointed finance minister the following month. However, Sharif’s government was unable to secure the final tranche of the $6.5 billion loan.

Amid worsening economic conditions, Pakistan was pushed to the brink of default. In May 2023, inflation soared to 38%, while foreign reserves fell to just over $3 billion.

Numerous meetings between Pakistani officials and the IMF followed, but no funds were released. In June 2023, Prime Minister Shehbaz Sharif averted default by securing a new $3 billion Stand-by Agreement (SBA) with the IMF.

After the completion of the parliament’s term, an interim government took office in August 2023, tasked with ensuring that the SBA stayed on track. It met key IMF conditions, such as maintaining fiscal discipline and allowing a market-determined exchange rate.

Following the February 2024 elections, Shehbaz Sharif returned as prime minister, appointing veteran banker Muhammad Aurangzeb as finance minister to stabilize the economy.

By August 2024, inflation had dropped to 9.6%, the lowest since October 2021, and foreign reserves had risen to over $9 billion, thanks to deposits from China, the UAE, and Saudi Arabia. In April, Aurangzeb’s Finance Division completed the SBA, leading to a new $7 billion loan agreement in July.

Why Has the IMF Not Approved the Loan?

While Dar attributes the delay to “geopolitical factors,” experts suggest that Pakistan’s failure to meet two key IMF demands is the real issue: securing debt rollovers from China, the UAE, and Saudi Arabia, and obtaining an additional $2 billion in financing.

“Pakistan is struggling to roll over its debt with bilateral lenders and is also facing challenges in securing $2 billion in financing,” economist Fahd Ali explained to Al Jazeera.

Ali noted that Pakistan has been in talks with Middle Eastern commercial banks for the financing, but the delay in finalizing these arrangements is holding up the IMF's approval.

The uncertainty has also shaken the stock markets, with minor declines reflecting concerns about the program’s future.

Economic analyst Shahbaz Rana highlighted that the instability in Pakistan’s political environment is affecting the government’s credibility, pointing to the ongoing tensions between the government and Imran Khan’s opposition party, Pakistan Tehreek-e-Insaaf (PTI), which claims the February election was rigged.

“They keep saying the IMF program will be finalised this week or next, but this only adds to the confusion,” Rana said.

Further doubts arose when Punjab, Pakistan’s largest and wealthiest province, announced a 45-billion-rupee ($161 million) electricity subsidy in August.

Although Punjab’s government claimed the subsidy would be funded without federal support, economist Safiya Aftab believes the IMF will likely reject it.

“The IMF has consistently emphasised the need to reduce and eliminate energy subsidies. I believe the Punjab government will eventually withdraw the subsidy, likely blaming the IMF,” Aftab told Al Jazeera.

Are Geopolitical Factors Causing the Delay?

Pakistan’s external debt stands at over $130 billion, with nearly 30% owed to China, its closest ally and a perceived rival to the Western bloc. The country faces repayments of almost $90 billion over the next three years, with the next major payment due by December.

During his London speech, Dar raised concerns about the IMF’s motives, suggesting they were pushing Pakistan toward default.

“We are a nuclear state. Every time we move toward economic success, our legs are pulled. The eight-month delay in funds disbursement is a crime in the economic life of a country,” he said.

However, academic Fahd Ali described Dar’s comments as “irresponsible and embarrassing” for a government negotiating with the IMF.

“The IMF wants Pakistan to stick to the agreed-upon plan. Any deviation will raise concerns for the Fund,” Ali said.

Ali added that previous IMF deals took place in a “geopolitical context” where Pakistani governments enjoyed more flexibility. The IMF, seen as dominated by the U.S., provided loans to Pakistan during and after the U.S. war in Afghanistan, viewing the support as crucial for its key ally.

In recent years, however, as Pakistan has moved closer to China, it has faced stricter IMF conditions.

“That space has disappeared, and recent governments have failed to interpret signals from the U.S. and the IMF,” Ali noted.

Rana, however, argued that the IMF’s fiscal targets for Pakistan are “unrealistic,” agreeing that Dar’s criticism holds some merit.

While Ali warned that failure to secure the IMF deal could be disastrous, Rana said Pakistan has some leeway.

“Pakistan can manage a further delay in the IMF program until November,” he said, noting that the country’s next major debt payments are due then. However, he cautioned that in the long term, Pakistan will need continued IMF support or must explore external debt restructuring to avoid default.