Liberals, NDP pass bill to enact 2-month GST holiday in House of Commons

As expected, Conservatives and Bloc Québécois vote against bill

The House of Commons has approved a bill that will temporarily eliminate the federal sales tax on select items, such as children's toys, books, restaurant meals, takeout, beer, and wine, for two months.

With support from the NDP, the minority Liberal government passed the legislation on Thursday night. However, the Conservatives and the Bloc Québécois opposed the measure, labeling it a "temporary two-month tax trick."

The legislation, which the Liberals and NDP agreed to fast-track, now moves to the Senate for consideration. If enacted, the GST exemption will take effect on December 14, lasting until February 15, 2025.

Initially, the Liberals proposed the tax holiday alongside a plan to issue $250 payments to 18.7 million Canadians earning $150,000 or less in 2023. However, concerns arose over some individuals being excluded from the cheques. The NDP demanded the proposals be split into separate bills, and the $250 payment measure was not included in the legislation passed on Thursday. It remains unclear when that measure will be introduced.

NDP Leader Jagmeet Singh has stated that his party would support the cheque initiative if it is expanded to include seniors, people with disabilities, and injured workers.

Prime Minister Justin Trudeau has presented the GST holiday as a measure to alleviate cost-of-living pressures. However, some economists warn it could have inflationary consequences in the spring.

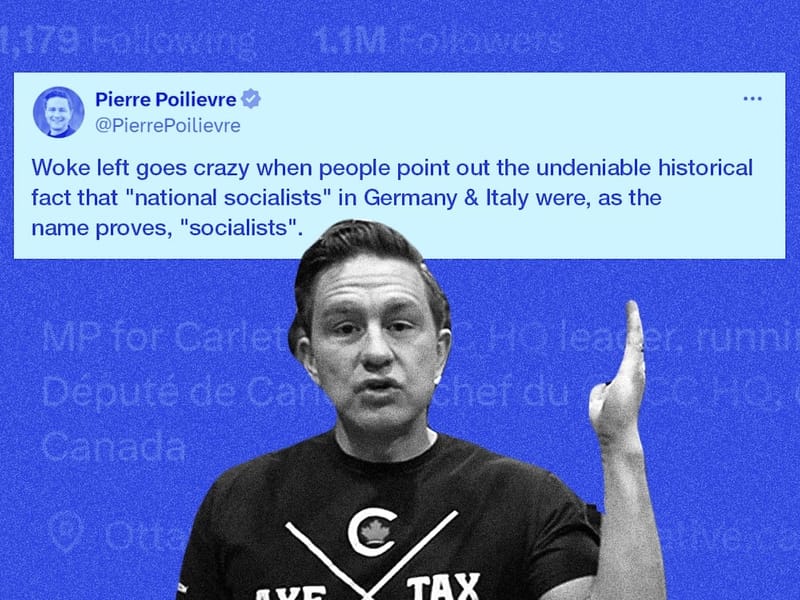

Conservative Leader Pierre Poilievre criticized the GST holiday, calling it a "temporary two-month tax trick" and urged the government to focus on measures like eliminating the carbon tax and removing the GST from new homes priced under $1 million. "My tax cuts are not just about lowering costs. They're about sparking more production," he argued.

The temporary GST exemption is projected to cost the federal government approximately $1.6 billion in lost revenue. In its current design, the $250 cheque initiative would cost an estimated $4.68 billion, according to a Finance Department official.

Government House Leader Karina Gould dismissed Poilievre’s criticisms as "disappointing" and emphasized the benefits of the measure. "For the people who it's going to benefit, which is every single Canadian, it's actually meaningful for them," she said.

The NDP has called for the GST to be permanently removed from essential items. NDP MP Alexandre Boulerice noted that while the two-month holiday is brief, it was a result of pressure his party placed on the Liberals. "We support the measure, not the Liberals," Boulerice stated.

The House has faced delays in regular proceedings due to opposition demands for the release of documents related to a now-defunct foundation tied to federal green technology funding. The NDP joined the Liberals in temporarily pausing this debate to prioritize the GST bill’s passage.