New houses and end to price-scooping: Harris sets economic objectives

The campaign's proposals include a "first-ever" tax credit for builders of homes sold to first-time buyers, as well as up to $25,000 in down-payment assistance for "eligible" first time buyers, a move that her campaign estimated could reach four million households over four years.

Kamala Harris has called for millions of new-build homes and first-time buyer help, tax breaks for families and a ban on grocery "price-gouging" in her first speech focused on economic policy.

The Democratic presidential nominee's plans build on ideas from the Biden administration and aim at addressing voter concerns after a surge in prices since 2021. Many of the proposals would require action from Congress, where similar ideas have stalled in the past. Donald Trump said the vice-president had already had more than three years with the administration to deliver her promises, which his campaign called "dangerously liberal".

"Where has she been and why hasn't she done it?" he asked.

Ms Harris hit back in a speech on Friday in North Carolina, stating: "I think that if you want to know who someone cares about, look at who they fight for.

"Donald Trump fights for billionaires and large corporations. I will fight to give money back to working and middle class Americans."

The campaign's proposals include a "first-ever" tax credit for builders of homes sold to first-time buyers, as well as up to $25,000 in down-payment assistance for "eligible" first time buyers, a move that her campaign estimated could reach four million households over four years.

She has also called for capping the monthly price of diabetes-drug insulin at $35 for everyone, finding ways to cancel medical debt, and giving families a $6,000 tax credit the year they have a new child.

She is supporting a federal law banning firms from charging excessive prices on groceries and urged action on a bill in Congress that would bar property owners from using services that "coordinate" rents.

Democrats and their allies are hoping Ms Harris will prove a more forceful and trusted messenger than President Joe Biden on economic pain.

Robert Weissman, the co-president of the consumer watchdog Public Citizen, characterised Ms Harris's plans as a "pro-consumer, anti-corporate abuse agenda".

"The [Biden] administration did talk about it but they did not promote proposed measures anywhere near as aggressive as Harris is doing," he said.

But pollster Micah Roberts, a partner at Public Opinion Strategies, said inflation was likely to remain a challenge for Democrats, noting that voters have a long history of trusting Trump - and Republicans - more on economic issues.

"Trump's been holding the advantage on this stuff for like a year plus," said Mr Roberts, the Republican half of a bipartisan team that recently conducted a survey on economic issues for CNBC, which found that Trump still held a big lead over Ms Harris on the topic.

Without a huge change, he said it would be "hard for me to believe" that the margin had suddenly closed.

Though analysts say some of Harris's proposals, such as the ban on price-gouging, are likely to be popular, they have also sparked criticism from some economists.

Bans on price-gouging already exist in many states, applied during emergencies such as hurricanes.

But economists say the term is difficult to define and widening such rules could end up backfiring, by discouraging firms from making more at times of short supply.

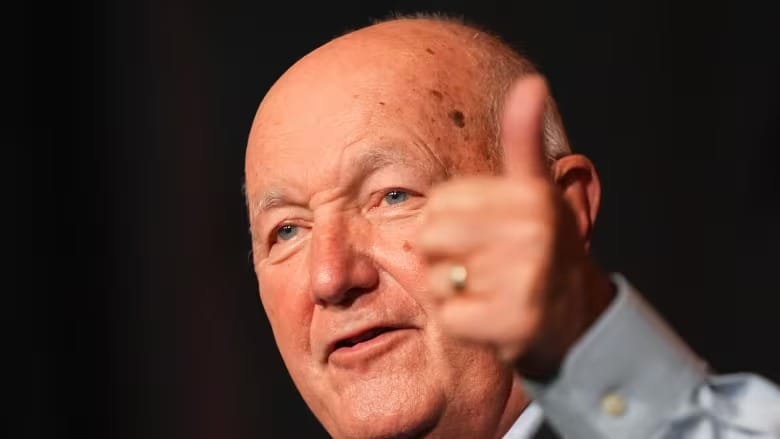

Michael Salinger, a professor of markets, public policy and law at Boston University's Questrom School of Business, said a similar ban was discussed when he served as the lead economist at the Federal Trade Commission during the administration of George W Bush.

"I thought then that it was a bad idea and I think now that it's a bad idea," he said. "To impose controls on competitive markets will lead to shortages - that's always been our experience."

He said the Harris campaign's other plans would also face questions, given their cost. For example, the proposal to increase the tax credit for children to as much as $3,600, which Congress did temporarily during the pandemic and opted against extending, would cost more than $1tn, according to some estimates.

With populism ascendant in both parties, that cost has not dissuaded Trump's choice for vice president, JD Vance, from backing an even bigger tax credit expansion.

Prof Salinger said Trump's other economic plans would be unlikely to tackle inflation concerns. Economists predict that increased drilling would have limited impact given the global nature of energy markets and have warned that Trump's pledge to impose a tax of 10% or more on imports would drive up prices.

As it stands, price increases have been subsiding, as the shocks from pandemic-era supply chain issues and the war in Ukraine fade.

Inflation, which tracks the pace of price increases, was 2.9% in July, the smallest annual increase since March 2021, the Labor Department said this week.

That is getting closer to the 2% pace considered normal, though prices are up roughly 20% since January 2021.

"The problem that people object to is that even if inflation is down, the prices are still higher and that's true but they're higher because of the natural working of market forces," Prof Salinger said.

"Trying to stand in the way of the working of market forces is a lot like trying to stop the tides," he added. "You just can't do it."