‘There will be winners and losers’: Markets brace for outcome of tight U.S. election race

As markets await the outcome of today’s U.S. presidential election, experts say there are a number of different strategies investors are using to hedge against uncertainty as the race remains too close to call.

As markets anticipate the results of today’s U.S. presidential election, experts note a range of strategies investors are employing to manage the uncertainty, as the race remains too close to predict.

“This is the most consequential election of our lifetime, and the two candidates are completely diametrically opposed,” said Dennis Mitchell, CEO and chief investment officer at Starlight Capital, in a Monday interview with BNN Bloomberg.

Mitchell explained that former president Donald Trump’s proposed cuts to the federal corporate tax rate are generally seen as favorable for U.S. stocks, though his tariff policies could drive up inflation, cutting into profits. By contrast, Democratic candidate Kamala Harris has indicated her administration would raise the corporate tax rate. Mitchell noted that while this could impact corporate profits, her plan may be less inflationary over time.

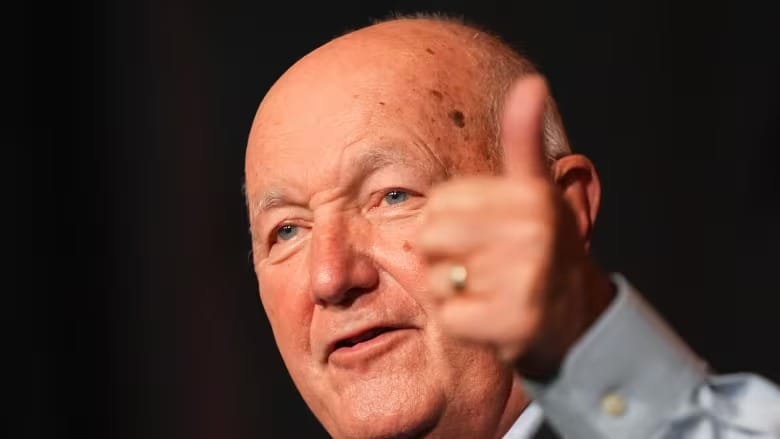

According to David Dietze, managing principal at Peapack Private Wealth Management, many investors are choosing to stay on the sidelines until the election is settled. “There’s a group of investors who just want to move to the sidelines ahead of this election… and just want to be out of the market,” Dietze told BNN Bloomberg. He pointed out that Warren Buffett has recently sold significant shares in major U.S. companies, including Apple and Bank of America.

Despite the lingering uncertainty, stocks have continued their bullish trend, suggesting investor confidence remains high, said Tim Urbanowicz, head of research at Innovator Capital Management. “Leading up to election day, you tend to see equities selling off and volatility increasing… but this cycle has really kind of broken that trend,” he noted.

Urbanowicz explained that the chances of a Democratic sweep in Congress and the White House—which could negatively impact U.S. stocks due to potential tax rate hikes—are seen as relatively low, around 15 percent. “I think we’ve seen volatility suppressed because investors see very low odds of that happening,” he said.

Urbanowicz emphasized that the market will see “winners and losers” based on whether Trump or Harris is elected. Michael Currie, senior investment adviser at TD Wealth, noted that different sectors have a clear preference depending on the outcome. Brianne Gardner, senior wealth manager at Velocity Investment Partners, added that renewable energy stocks would likely benefit under a Harris administration, whereas the oil and gas sector might perform better with Trump.

Urbanowicz warned that investors hoping to predict the winner before all votes are counted may struggle, as polling data and betting odds are not always aligned. “It’s going to be neck-and-neck… and I would anticipate volatility kicking up in light of that race tightening,” he said.

After the 2020 election, Joe Biden’s win was declared only days after election day, leading to a period of uncertainty as Trump contested the results. Mitchell stated that a similar scenario would not significantly impact markets this time. “Markets are going to ignore all of the noise… What they will focus on is who is actually going to win,” he said, adding that markets have learned from Trump’s previous unsuccessful legal challenges.