Trudeau government to announce GST vacation on certain items before Christmas

Measures to be announced Thursday designed to help families hit by rising prices

The federal government and the New Democratic Party (NDP) have agreed to implement a temporary two-month suspension of the Goods and Services Tax (GST) on select items ahead of the holiday season. This measure, part of a broader relief package aimed at easing financial pressures on families, is expected to be announced on Thursday and take effect before Christmas.

Key items covered by the GST suspension include certain grocery products, such as beer, wine, and prepared hot meals, along with diapers, children's clothing, shoes, car seats, and toys. Additionally, the government plans to issue cheques in the spring to Canadians within specific income brackets, according to sources familiar with the discussions.

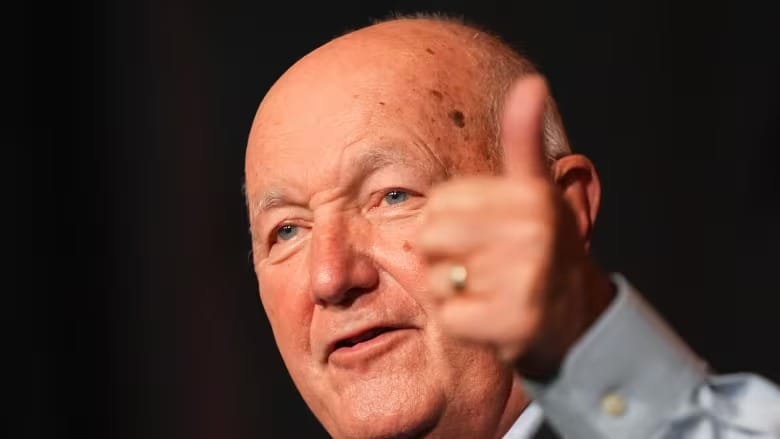

These initiatives will be consolidated into a single bill, which the NDP intends to support in the House of Commons. NDP leader Jagmeet Singh confirmed his party’s backing for the proposal, stating, "The NDP will vote for this measure because working people are desperate for relief, and we're proud we delivered for them again."

Efforts are being made to expedite the passage of the bill, potentially easing a legislative gridlock that has disrupted parliamentary proceedings since late September. The impasse originally stemmed from a dispute over unredacted documents related to a defunct green technology foundation.

It remains uncertain whether these measures will be integrated into the Liberal government’s fall economic statement or treated as standalone legislation. Regardless, the Liberals will need support from at least one opposition party to ensure the survival of their minority government, particularly if new spending triggers a confidence vote.

This collaboration between the Liberals and NDP does not signify blanket support from the New Democrats for the government’s broader economic agenda. While the GST holiday is seen as a positive step, the NDP has outlined additional priorities, including permanently removing GST from essentials like groceries, diapers, children's clothing, internet bills, and home heating. To offset the estimated $5 billion annual revenue loss from such measures, the NDP has proposed a tax on excessive corporate profits.

Prime Minister Justin Trudeau aims to shift focus toward addressing cost-of-living concerns and improving poll standings, where his party trails the opposition by a significant margin. This announcement comes amid challenges within Parliament, including recent controversy surrounding Employment Minister Randy Boissonnault, who resigned over issues related to business dealings and claims about his Indigenous heritage.

Singh has also called on provincial governments to match the NDP’s pledge by removing their respective sales taxes on essential goods, emphasizing his commitment to further reduce Canadians’ financial burdens. While the NDP supports the temporary GST suspension, Singh reiterated the party’s intention to campaign for permanent tax relief on everyday necessities.